TSMC to expand outsourced CoWoS CoW to ease 2.5D AI chip bottlenecks in H2 2026

TSMC will expand outsourced CoWoS (CoW) in H2 2026, tapping ASE/SPIL and Amkor to boost 2.5D packaging for AI chips and ease persistent capacity bottlenecks.

TSMC will expand outsourced CoWoS (CoW) in H2 2026, tapping ASE/SPIL and Amkor to boost 2.5D packaging for AI chips and ease persistent capacity bottlenecks.

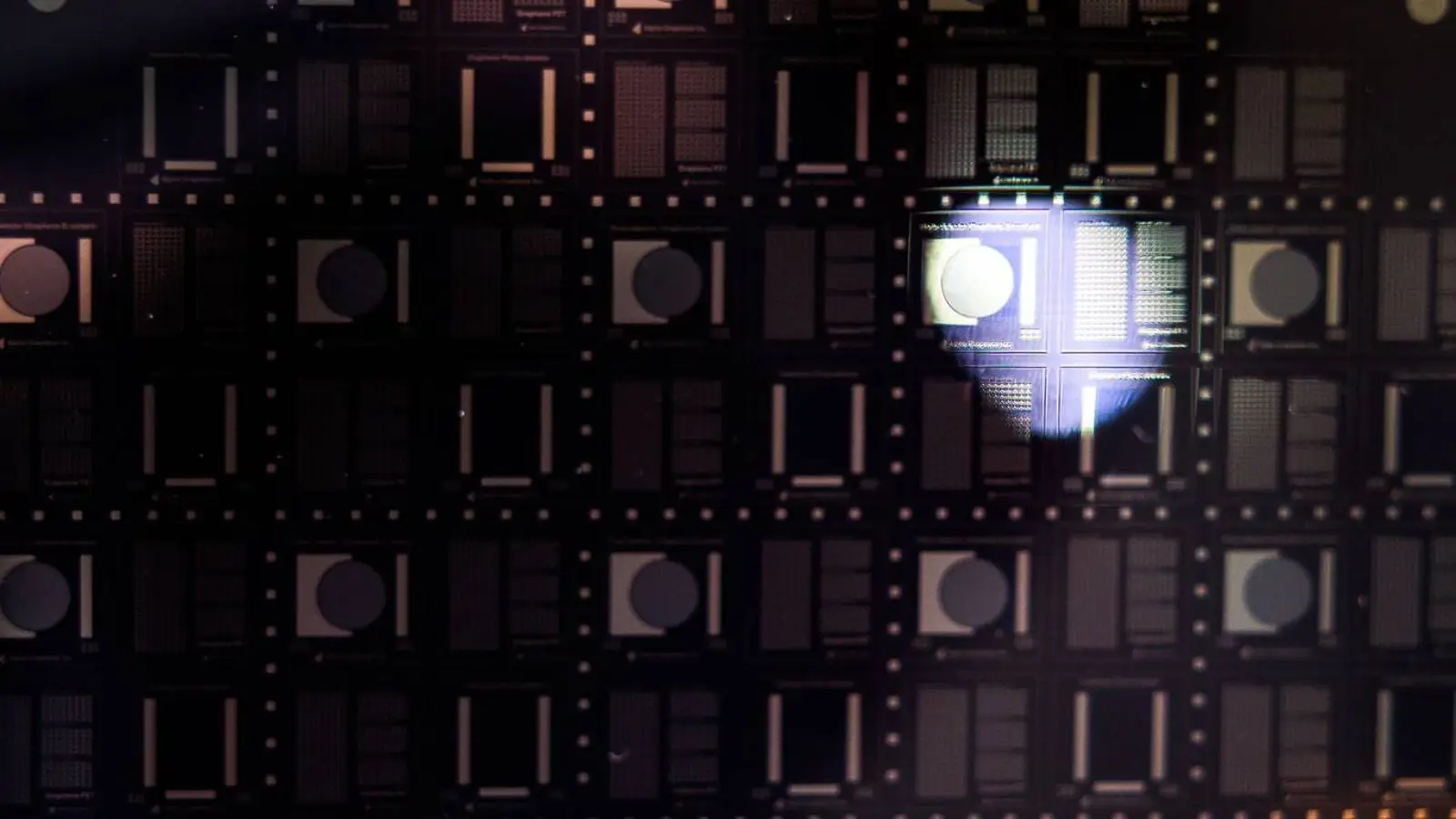

© D. Novikov

TSMC is preparing a major expansion of outsourced work for its advanced CoWoS packaging in the second half of 2026. The focus is on the CoW stage (Chip-on-Wafer) within 2.5D packaging, widely viewed as the most mature and high-throughput way to integrate multiple chips—particularly valuable for AI systems.

CoWoS has long been central to the plans of leading AI processor developers, and TSMC has steadily built up in-house capacity over recent years. Even so, third-party packaging and testing contractors (OSAT) remain essential to the ecosystem. Key partners include ASE (Sun Moon Light), its subsidiary SPIL, and Amkor, which take on part of the server-focused and production workload.

According to Taiwan’s Electronic Times, TSMC intends to substantially increase external production of CoW processes starting in the back half of 2026. The move is expected to ease the capacity crunch in the 2.5D packaging market, a bottleneck that continues to constrain shipments of cutting-edge AI chips. The timing suggests the company is aligning supply with a demand curve that still runs hot.

Back in 2024, there were already reports that CoW orders had begun to flow to outside firms. At the time, the industry was talking about hurdles such as pauses in tech transfer and difficulties scaling to mass production, which kept actual shipment volumes limited. Against that backdrop, a larger handoff in 2026 looks like a pragmatic next step rather than a sudden pivot.

By the end of 2026, current forecasts point to TSMC’s own CoWoS output reaching about 125,000 wafers a month. In parallel, OSAT partners could lift combined capacity to as much as 40,000 wafers a month—an important addition as AI-driven demand continues to climb. If realized, that extra headroom should relieve pressure across the supply chain, even if it won’t make the appetite for compute any less insatiable.