TSMC’s 2-nm capacity crunch: AI demand, price hikes, and Apple’s early lock-in

TSMC faces a global 2‑nm chip shortage as AI demand soars. Capacity is booked into 2026, prices set to rise 3–10%, Apple locks supply, and 3‑nm lines tighten.

TSMC faces a global 2‑nm chip shortage as AI demand soars. Capacity is booked into 2026, prices set to rise 3–10%, Apple locks supply, and 3‑nm lines tighten.

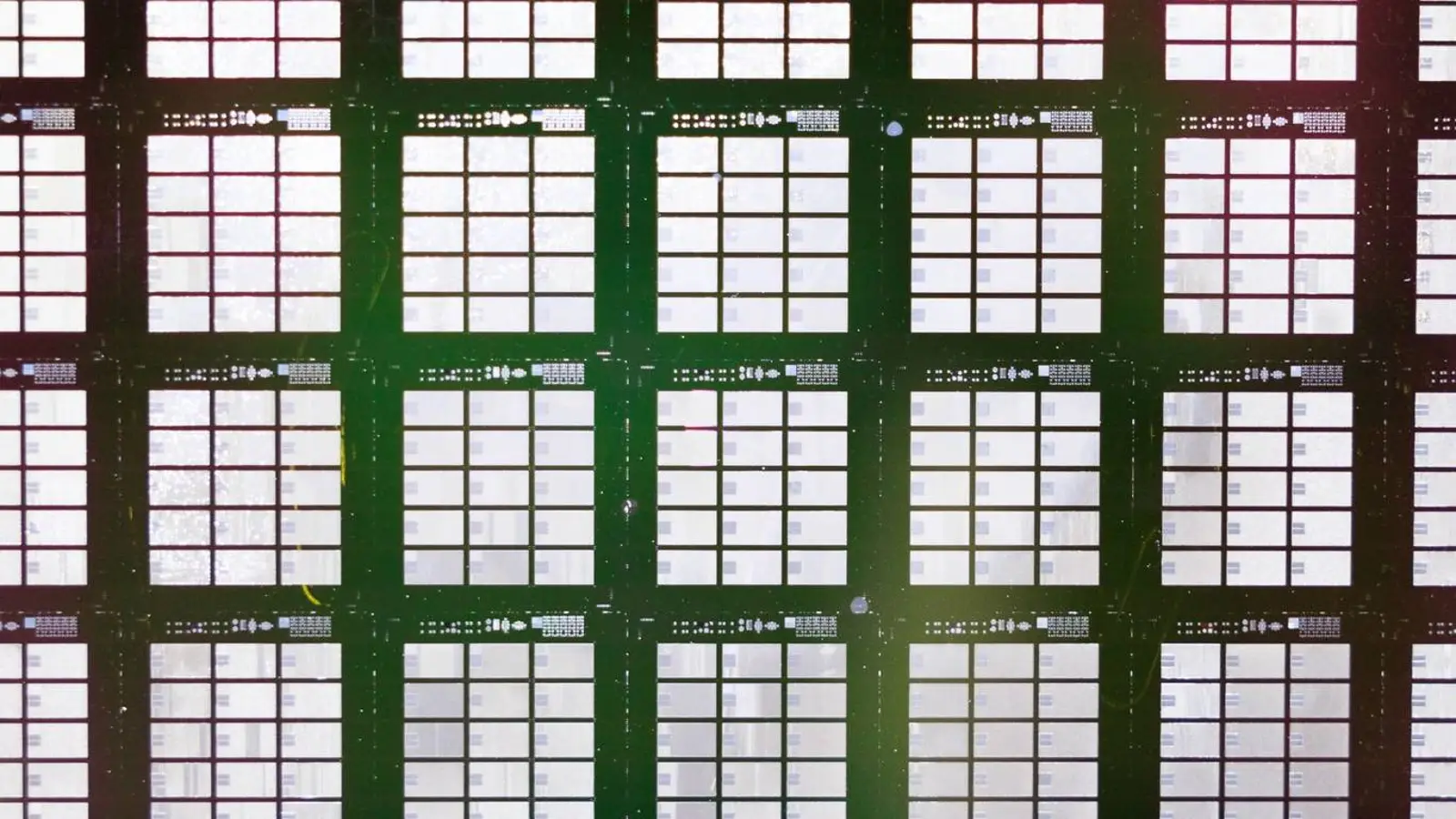

© D. Novikov

Taiwanese giant TSMC has found itself at the center of a worldwide shortage of cutting-edge semiconductors. Industry sources say demand for the 2-nm node is so intense that the company’s production slots are already spoken for at least through the end of 2026. The surge is fueled by the AI boom and by major players rushing to lock in manufacturing for future chips. In effect, early movers have ring-fenced scarce capacity, leaving laggards with fewer levers to pull.

Against this backdrop, TSMC has notified customers about price increases. The hikes will begin in 2026 and, according to preliminary guidance, continue for four consecutive years. The first adjustment is expected to stay within single digits, while analysts allow for a 3–10% range depending on order size and contract terms.

The strain isn’t limited to 2 nm. TSMC’s 3-nm lines are projected to reach peak utilization by 2026, setting up their own shortages and potentially adding roughly another 3% to costs. Alternatives exist—Samsung’s 2-nm GAA among them—but many clients continue to favor TSMC for its stability and strong yield rates. That preference, while understandable, tightens the bottleneck even further.

Apple remains the marquee customer: analysts estimate it already contributes about 24% of TSMC’s total revenue. Reports indicate Apple has pre-booked more than half of the capacity for 2-nm A20 and A20 Pro chips, which leaves competitors such as Qualcomm and MediaTek with limited room or a need to move to the later N2P process. The balance of power clearly tilts toward those who secured access early.

To ease the overload, TSMC is building three new fabs dedicated to 2-nm production, but bringing them online will take time. Until then, the market will operate in a climate of scarcity, rising price tags, and fierce competition for the most advanced process technologies.