TSMC capacity squeeze pushes AI chip orders to Samsung and Intel Foundry

With TSMC's lines at capacity, chip designers turn to Samsung and Intel Foundry. 2 nm costs, SF2, and 18A/14A are reshaping the chip foundry landscape.

With TSMC's lines at capacity, chip designers turn to Samsung and Intel Foundry. 2 nm costs, SF2, and 18A/14A are reshaping the chip foundry landscape.

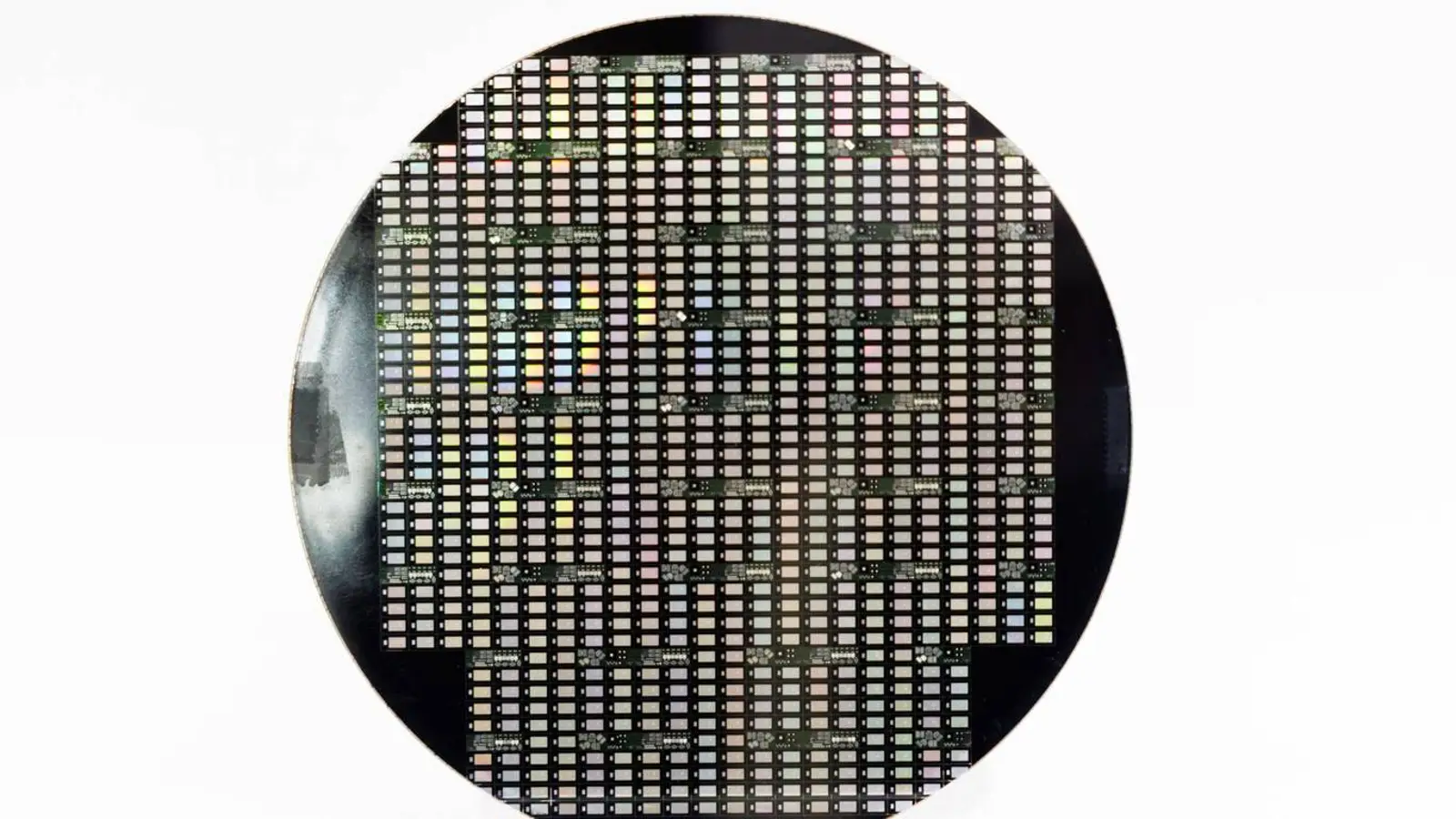

© D. Novikov

TSMC’s overloaded production lines are starting to redraw the balance of power in the chip foundry market. According to Korean media, capacity limits at the Taiwanese giant are pushing companies without in-house fabrication to look elsewhere, and Samsung Foundry is increasingly viewed as a serious, competitive option.

Demand for TSMC’s services is at a record high. The company is handling not only mobile heavyweights such as Apple, Qualcomm, and MediaTek, but also key players in high-performance computing and AI, including NVIDIA and AMD. With orders climbing and the 2 nm process getting pricier, production lines are effectively booked solid, and for lower-priority customers, lead times and output are becoming less predictable. In a queue like that, certainty turns into a scarce resource.

Time, more than anything, is emerging as the decisive factor for many chip designers. Even though TSMC has long been the default choice, placing orders with an overburdened supplier now looks risky. In this context, Samsung Foundry comes off as an appealing alternative, promising more flexible terms and available capacity. For some teams, shaving weeks off a ramp can matter more than sticking to the familiar playbook.

Reports indicate that Meta* is weighing the production of its MTIA AI accelerators at Samsung using the SF2 process. Qualcomm and AMD are also mentioned among potential customers. The interest in Samsung stems not only from progress in its process technology, but also from spillover demand migrating from TSMC—exactly the flow Samsung aims to capture.

At the same time, Intel Foundry is drawing attention as well, particularly with its 18A and 14A processes. For American companies, geography and Intel’s status as a major U.S.-based manufacturer add extra appeal. The industry is clearly moving toward more diversified supply chains, with Samsung and Intel poised to play a far more visible role than before. If this momentum holds, the foundry landscape may finally look less one-sided.

* Meta is designated as an extremist organization, and its activities are banned in Russia.