DRAM packaging and testing costs jump 30% as AI booms

DRAM and HBM packaging and testing costs are up 30% as Powertech, ChipMOS and Walton hike prices. AI demand fuels a memory supercycle squeezing PC buyers.

DRAM and HBM packaging and testing costs are up 30% as Powertech, ChipMOS and Walton hike prices. AI demand fuels a memory supercycle squeezing PC buyers.

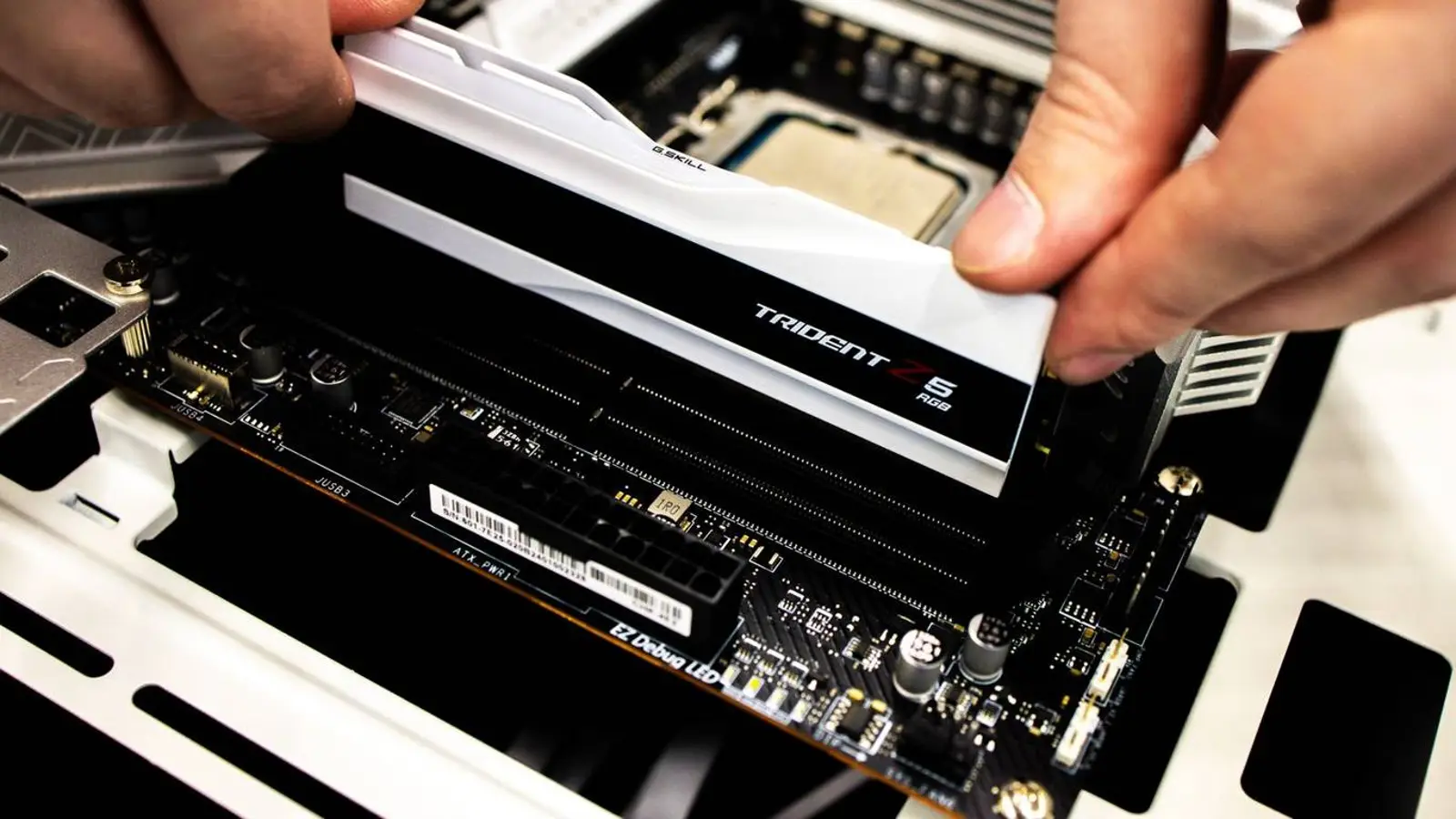

© A. Krivonosov

The memory market keeps getting more expensive at a rapid clip, and the squeeze, by the looks of it, is only just beginning. On top of rising prices for DRAM chips themselves, the cost of packaging and testing has jumped sharply. According to Taiwanese sources, Powertech, ChipMOS and Walton have announced 30% price increases, with a second wave of hikes already looming.

These firms handle the final steps of memory production—testing, validation and packaging of DDR4, DDR5 and HBM modules—before shipments go to customers. As Micron, Winbond and other makers step up deliveries, demand for these services has surged. The strongest pressure is coming from AI-focused companies that rely on the most complex and expensive memory types.

Powertech offers a telling case. After Micron reallocated its internal capacity, some higher-level operations, including work on DDR5 and mobile graphics memory, moved to partners. That shift lifted Powertech’s share of premium orders and pushed its lines close to full utilization. Yet the avalanche of demand has triggered a price reset now felt across the supply chain.

Most packaging and testing specialists are concentrated in Taiwan, but demand is running hot in China as well. East China, which focuses on niche memory types, also reports a pronounced increase in factory utilization. Industry representatives say the market has entered a full-fledged supercycle, fueled by unprecedented AI demand, and it could run through 2028.

In practice, that points to further price increases not only for data centers but for everyday users too. Shortages and higher memory costs are already weighing on the PC market, pushing up prices for components and even related materials such as aluminum and copper. With experts not expecting stabilization in 2026, any relief, at this pace, feels distant.