Samsung's 2nm chip yield concerns and future prospects

Explore Samsung's 2nm GAA chip yield issues, KeyBank's skepticism, and optimism from Exynos 2600 and Texas factory retooling for 2027 goals.

Explore Samsung's 2nm GAA chip yield issues, KeyBank's skepticism, and optimism from Exynos 2600 and Texas factory retooling for 2027 goals.

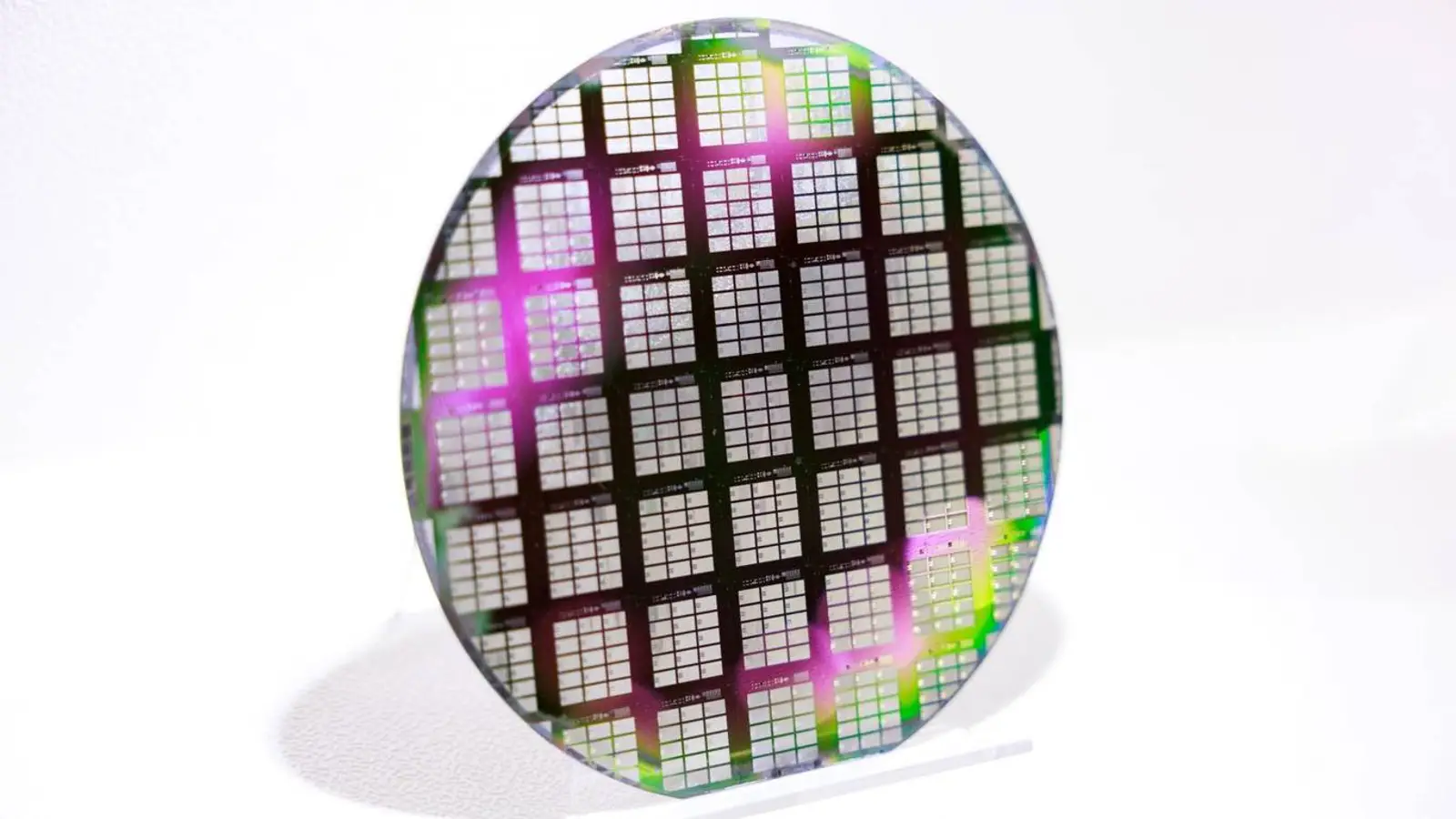

© D. Novikov

Samsung faces renewed skepticism about its 2-nanometer GAA chipmaking process. Investment firm KeyBank estimates the yield of viable chips is below 40%, a figure that sharply contradicts more optimistic industry reports. Analysts suggest this performance level could hinder the Korean manufacturer's efforts to attract key clients and achieve its targeted profitability by 2027.

This creates a contradictory picture. Earlier reports indicated Samsung had managed to push 2-nm GAA yields to around 50%, especially following the troubled 3-nm generation where production issues drove many customers to TSMC. Furthermore, the upcoming Exynos 2600, Samsung's first 2-nm chip, is based on this very process and is already being considered for future devices, including the Galaxy Z Flip 8 foldable smartphone.

Additional optimism stems from Samsung's factory in Taylor, Texas. Originally prepared for 4-nm production, the facility is now being actively retooled for 2-nm wafers. Test runs with ASML's EUV equipment are slated to begin in March, potentially positioning Samsung as a real alternative to TSMC, whose capacity is so overloaded that clients are reportedly willing to pay double for production access.

In practice, KeyBank's doubts appear even more puzzling against the backdrop of reports about Samsung's multi-billion dollar contracts, including a collaboration with Tesla. It seems unlikely such deals could be secured with a critically low chip yield. The market may simply lack current data on Samsung's actual progress, or investor assessments may be overly cautious.