Fujitsu teams with Rapidus and Nvidia on 1.4 nm supercomputer processors

Fujitsu plans 1.4 nm MONAKA-X supercomputer processors with Rapidus and Nvidia, targeting 2027–2030 rollout to boost Japan’s semiconductors and AI data centers.

Fujitsu plans 1.4 nm MONAKA-X supercomputer processors with Rapidus and Nvidia, targeting 2027–2030 rollout to boost Japan’s semiconductors and AI data centers.

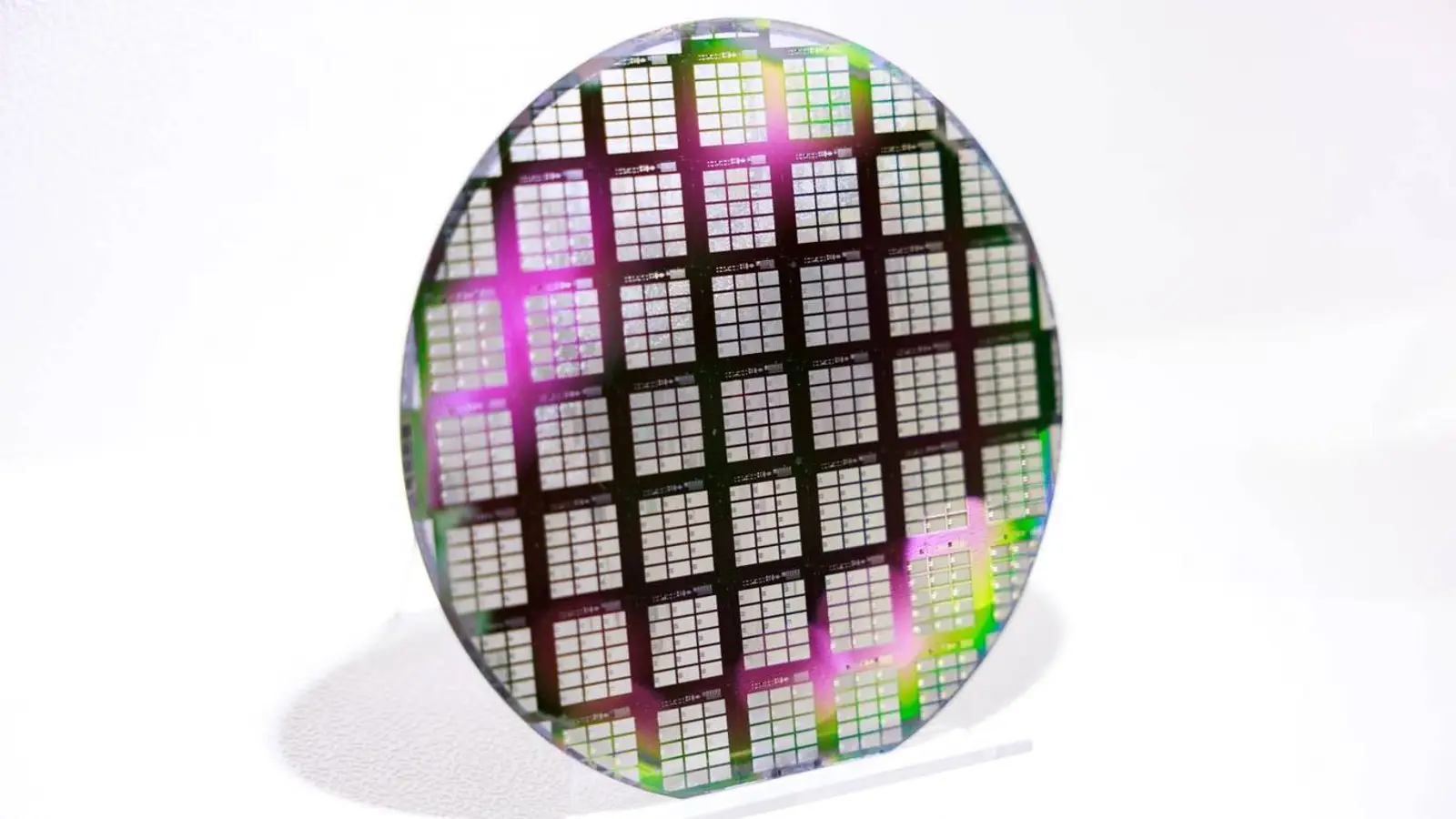

© D. Novikov

According to recent information, Fujitsu is exploring a partnership with Japanese chipmaker Rapidus to move its supercomputer processors to a 1.4 nm manufacturing process. The move could speed the adoption of advanced computing technologies in Japan and support the country’s plan to revive its domestic semiconductor industry.

In early October, Fujitsu announced a collaboration with Nvidia to develop artificial intelligence chips for Japanese data centers, with deployment targeted by 2030. The company is also considering handing off to Rapidus the production of one of its 1.4 nm supercomputer processors, scheduled to roll out in 2029.

The new supercomputer co-developed by Fujitsu and Nvidia carries the codename “Tomitake NEXT” and will succeed Japan’s existing “Tomitake” system. Its performance is projected to be 100 times higher than its predecessor. The key component—the “FUJITSU-MONAKA-X” processor—is expected to reach practical use by 2027.

The current MONAKA is produced using a 2 nm process at TSMC. The future MONAKA-X is planned to advance to a 1.4 nm node, with core specifications to be finalized by March 2026. Fujitsu is interested in manufacturing these chips with both TSMC and Rapidus and plans to invest in Rapidus to position the company as a potential foundry for MONAKA-X and future chips. Framed this way, the roadmap looks ambitious yet measured: secure the specs by early 2026, bring the processor to practical use by 2027, launch the 1.4 nm part in 2029, and aim for data-center deployment by 2030.

Rapidus was founded in 2022 with backing from eight major Japanese companies, including DENSO, Kioxia, Bank of Mitsubishi UFJ, NEC, NTT, Softbank, Sony, and Toyota Motor. The company aims to strengthen Japan’s position in semiconductors and become a key manufacturer of leading-edge chips for supercomputers. If the pieces come together, this trajectory would underline Japan’s intent to rebuild capacity at the forefront of high-performance computing.