U.S.-China chip curbs: licenses revoked for Samsung and SK Hynix in China

The U.S. will revoke licenses for Samsung and SK Hynix to buy chip equipment in China, reshaping semiconductor supply chains and pressuring NAND, DRAM output.

The U.S. will revoke licenses for Samsung and SK Hynix to buy chip equipment in China, reshaping semiconductor supply chains and pressuring NAND, DRAM output.

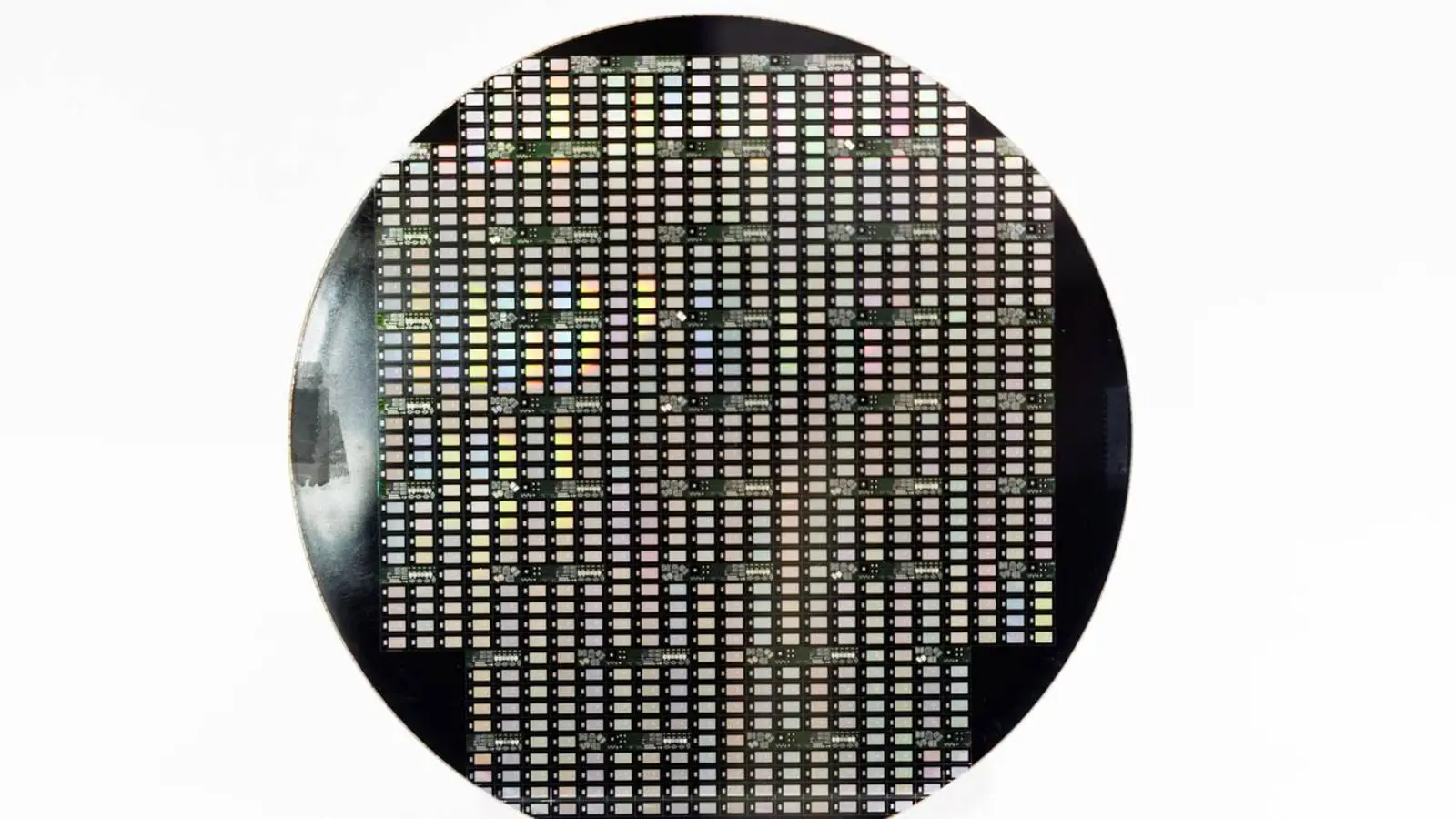

© D. Novikov

The U.S.–China trade standoff has once again shaken the global semiconductor industry. The U.S. Department of Commerce said it will revoke licenses that had allowed South Korean heavyweights Samsung and SK Hynix to import American equipment for their factories in China. The new curbs will take effect in 120 days.

This is not about shuttering fabs, but the companies will no longer be able to upgrade or expand output using the latest U.S. technology. For Samsung, the Xi’an plant is especially pivotal, accounting for roughly 40% of global NAND production. SK Hynix, in turn, risks running into trouble with DRAM output. In China, both groups mostly manufacture on mature process nodes (28 nm and above), while keeping their most advanced work in South Korea and the United States.

Washington officially frames the move as a national-security measure aimed at slowing China’s technological progress and preventing any military use of the equipment. Yet the decision injects long-term uncertainty: companies will be unable to replace failed tools or buy new systems from U.S. suppliers.

Experts note that the temporary waivers in place since 2022 helped keep the global supply chain in balance. With that change, room could open for Chinese equipment makers and for the American rival Micron. In the meantime, more than 20,000 Samsung and SK Hynix employees in China are left facing instability. South Korea’s trade ministry is already negotiating to soften the impact, but Washington’s strategic direction is unmistakable: move advanced chipmaking farther from China. That trajectory nudges manufacturers to prepare for a future with fewer safe bets.